90% of top lenders use FICO® Scores

View my FICO Scores nowFICO® Score, The Score That Matters®

FICO Scores are an industry standard

90% of top lenders use FICO® Scores. So when you apply for a loan, it's likely your lender will be checking your FICO Scores to determine how much you can borrow and how much interest you'll pay.

They're based on your credit history

FICO® Scores make lending fairer. They summarize your credit history using a scientific algorithm so lenders can make well informed decisions. They're based on your financial decisions, so they change as your credit reports change.

They can save you thousands of dollars

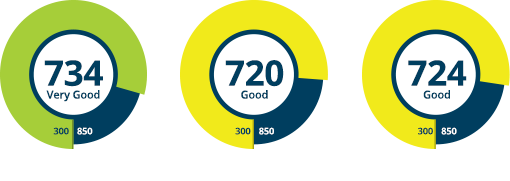

High FICO® Scores can give you access to the best loan and credit card rates – and those savings really add up. Prepare for your next loan by monitoring changes, and get a better understanding of your full credit picture.

Access everything you need to understand your credit

Find out which product is right for you

Whether you're planning for a large purchase or just want to see where you stand, there's a FICO® Score product that's right for you.

Answer 2 - 4 questions to find out which product fits your needs.

Let's Get Started!Do you want to view your credit reports from one credit bureau or all three? (Lenders may check with any or all three bureaus)

1 credit bureau

3 credit bureau

Do you want to track changes to your credit over time?

Yes

No

Not sure

Are you worried about identity theft?

Yes

No

Not sure

Are you preparing for a loan?

Yes

No

FICO® Score 1B Report

- Access to a FICO® Score 8 and credit report from the bureau of your choice

- View additional FICO® Score versions commonly used in mortgage, auto and credit card lending — 9–10 per bureau

- Use the FICO® Score Simulator to simulate how financial decisions may impact a FICO Score 8

- Detailed analysis of your FICO Score 8

*IMPORTANT INFORMATION: All FICO® Score products made available on myFICO.com include a FICO® Score 8, and may include additional FICO® Score versions. Your lender or insurer may use a different FICO® Score than the versions you receive from myFICO, or another type of credit score altogether. Learn more.

FICO® Score 3B Report

- Access to a FICO® Score 8 and credit report from all three bureaus

- Compare differences in each report in one side-by-side view

- View 25 additional FICO® Score versions commonly used in mortgage, auto and credit card lending

- Use the FICO® Score Simulator to simulate how financial decisions may impact a FICO Score 8 from each bureau

- Detailed analysis of your FICO Score 8 for each bureau

*IMPORTANT INFORMATION: All FICO® Score products made available on myFICO.com include a FICO® Score 8, and may include additional FICO® Score versions. Your lender or insurer may use a different FICO® Score than the versions you receive from myFICO, or another type of credit score altogether. Learn more.

FICO® Basic

- Monthly access to a new Experian credit report & 10 FICO® Scores

- View your FICO® Score versions commonly used in mortgage, auto and credit card lending based on Experian data

- FICO Score® 8 update alerts†

- Monitoring for changes in your Experian credit report†

- FICO® Score Simulator

- Detailed analysis of your FICO Score 8 based on Experian data

- Lost wallet protection‡

- 24/7 full-service ID restoration

- $1 million Identity theft insurance§

IMPORTANT INFORMATION:

*Your subscription will automatically renew monthly at $19.95 unless you cancel. You may cancel at any time; however partial month refunds are not available. All FICO® Score products made available on myFICO.com include a FICO® Score 8, and may include additional FICO® Score versions. Your lender or insurer may use a different FICO® Score than the versions you receive from myFICO, or another type of credit score altogether. Learn more.

† Not all credit report data or transactions are monitored. Monitored credit report data, monitored credit report data change alerts, FICO® Score updates, FICO® Score alerts, monitored transactions, and alert triggers, timing and frequencies vary by credit bureau. Other limitations apply. Learn more.

‡ Lost wallet protection provides coverage of: credit cards, debit cards, checkbooks, driver's licenses, Social Security cards, insurance cards, passports, military identification cards, traveler's checks and Medicare or Medicaid identification. Other limitations, restrictions and exclusions may apply. See terms and conditions.

§ The Identity Theft Insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits.

3-Bureau Monitoring Plus Credit Reports

- Monthly or Quarterly access to a new 3-bureau credit report & 28 FICO Scores

- View the most widely used FICO® Scores versions commonly used in mortgage, auto and bankcard lending

- 3-bureau credit report monitoring†

- FICO® Score 8 update alerts for each bureau†

- FICO® Score Simulator for each bureau

- Detailed analysis of your FICO® Score 8 from each bureau

- Identity theft monitoring

- Lost wallet protection‡

- 24/7 full-service ID restoration

- $1 million Identity theft insurance§

IMPORTANT INFORMATION:

*Your subscription will automatically renew monthly at $39.95 unless you cancel. You may cancel at any time; however partial month refunds are not available. All FICO® Score products made available on myFICO.com include a FICO® Score 8, and may include additional FICO® Score versions. Your lender or insurer may use a different FICO® Score than the versions you receive from myFICO, or another type of credit score altogether. Learn more.

**Your subscription will automatically renew monthly at $29.95 unless you cancel. You may cancel at any time; however partial month refunds are not available. All FICO® Score products made available on myFICO.com include a FICO® Score 8, and may include additional FICO® Score versions. Your lender or insurer may use a different FICO® Score than the versions you receive from myFICO, or another type of credit score altogether. Learn more.

† Not all credit report data or transactions are monitored. Monitored credit report data, monitored credit report data change alerts, FICO® Score updates, FICO® Score alerts, monitored transactions, and alert triggers, timing and frequencies vary by credit bureau. Other limitations apply. Learn more.

‡ Lost wallet protection provides coverage of: credit cards, debit cards, checkbooks, driver's licenses, Social Security cards, insurance cards, passports, military identification cards, traveler's checks and Medicare or Medicaid identification. Other limitations, restrictions and exclusions may apply. See terms and conditions.

§ The Identity Theft Insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits.

Setting the record straight on credit scores

Make sure you don't fall for these three common credit myths.

FICO® Scores have been in use for over 25 years, and they are used by 90% of top lenders.

FICO® Scores have been in use for over 25 years, and they are used by 90% of top lenders.

FICO® Scores have been in use for over 25 years, and they are used by 90% of top lenders.

FICO® Scores have been in use for over 25 years, and they are used by 90% of top lenders.

‡ Credit card ratings: Editors from CardRatings.com rate credit cards objectively based on the features the credit card offers consumers, the fees and interest rates, and how a credit card compares with other cards in its category. Ratings vary by category, and the same card may receive a certain number of stars in one category and a higher or lower number in another.

The ratings are the expert opinion of the editors from CardRatings.com, and not influenced by any remuneration their website may receive from card issuers.