How it works

myFICO makes it easy to understand your credit with FICO Scores, credit reports and alerts from all 3 bureaus. See how it works, and learn how we can help you.

View Plans

FICO Scores:

Get the right score for your credit goals

FICO® Scores are the only credit score used by 90% of top lenders. Other credit scores can vary as much as 100 points. Knowing your FICO Scores helps you apply for loans with confidence and avoid surprises.

We provide FICO Scores based on your Experian, TransUnion and Equifax reports. When you apply for credit, lenders may use one or more of these bureaus.

With standard and industry specific versions of the FICO Score, you can get the right score for your goal, including the versions most frequently used when you apply for a mortgage, auto loan or credit card.

Credit Reports:

Check your 3-bureau credit report

We provide full credit reports, with details about your accounts and inquiries along with any collections and public records.

With our 3-bureau reports, you can view a side-by-side comparison of your information from Experian, TransUnion and Equifax. This helps you spot errors and understand score differences. Reviewing and fixing errors in your credit report may have a significant impact on your credit score.

Our regular updates help you keep your credit report accurate.

Credit Monitoring:

Stay on top of changes to your credit

We constantly monitor your credit files at Experian, TransUnion and Equifax and notify you of important changes, such as inquiries, new accounts, address changes, late payments and more.

Monitoring your credit helps you prepare for a loan, understand how credit works and detect early signs of fraud.

FICO Score Monitoring:

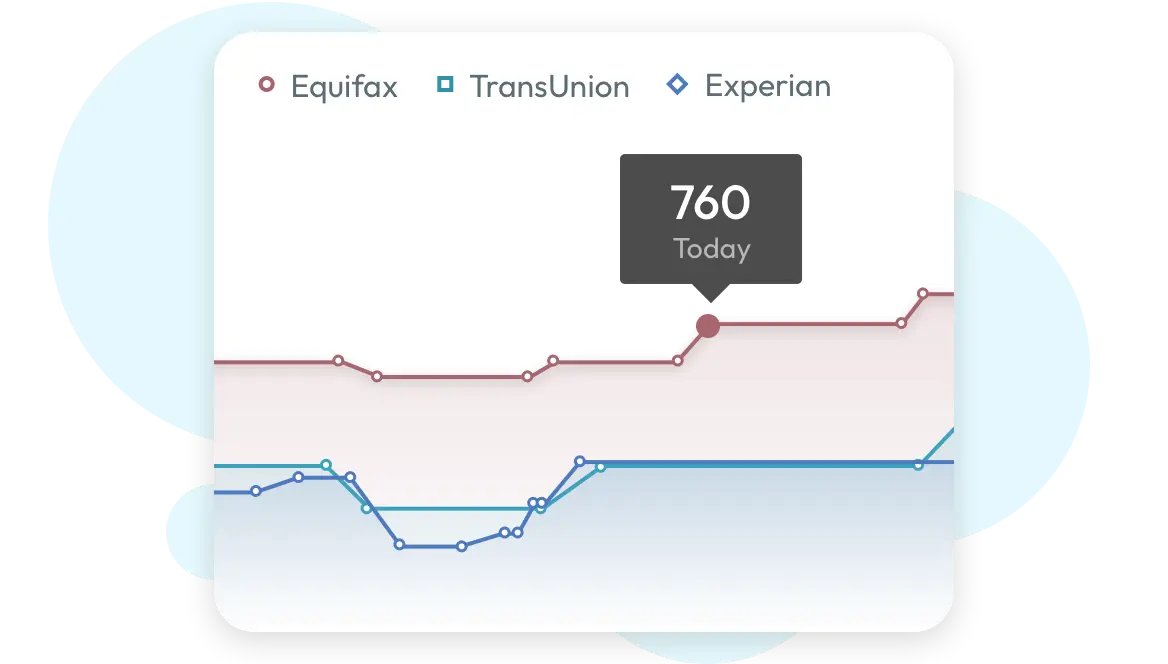

Get FICO Score updates

We notify you of monitored changes to your FICO Score. With every credit monitoring alert, we include your current FICO Score (version 8). Score monitoring helps you see how credit changes affect your score.

With our score history graph, you can track your score progress as you work towards your goal.

Identity Monitoring:

Detect threats to your identity

We scan and alert you to potential threats to your identity with advanced identity theft monitoring. We constantly scan thousands of websites, chat rooms and other Internet databases for the buying, selling or trading of your personal information, and alert you if your information is discovered.

We also search public records for other possible signs of identity theft like new names or addresses tied to your Social Security number.

Identity Restoration:

Recover from identity theft

If you become a victim of identity theft, we're here to help with identity theft restoration and insurance. You will have up to $1,000,000 in identity theft insurance, including coverage for data breaches, a stolen identity and fraud. Our US-based identity theft experts are on call 24/7 to help you restore your identity or recover from a lost wallet.

The identity theft insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company. Please refer to the actual policies for terms, conditions and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits.

Tools & Analysis:

Take aim at your credit goals

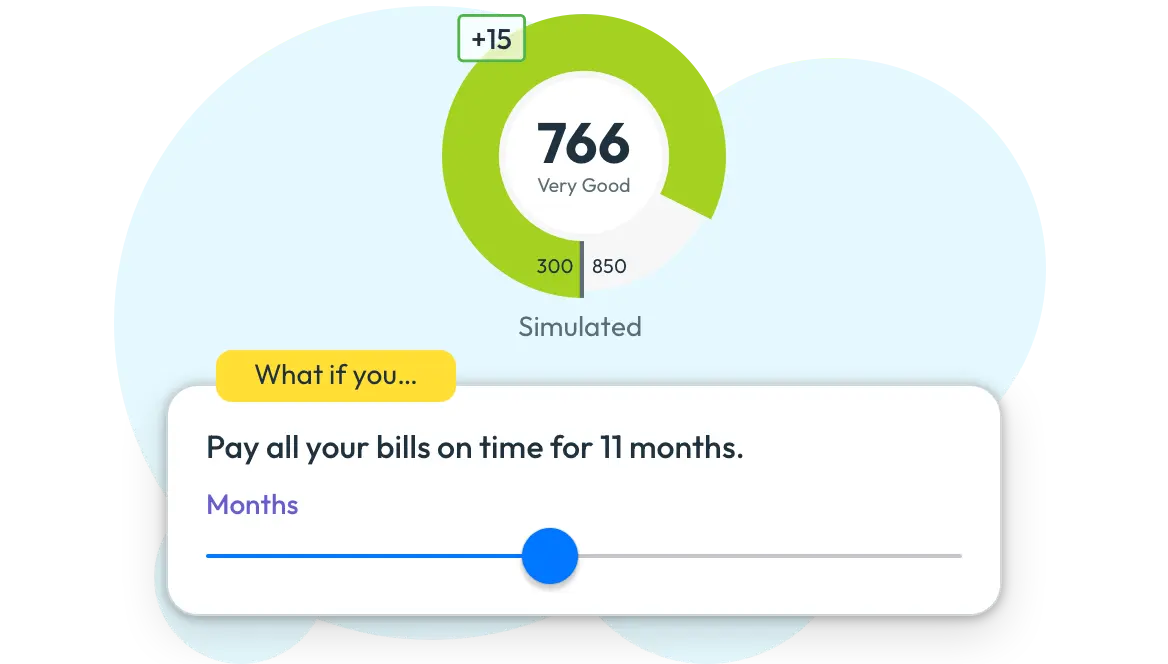

Use our tools and analysis to simulate credit events and gain insights into your credit.

See what could happen to your FICO Score (version 8) if you take out a mortgage, pay down a credit card and more. Compare side-by-side simulations for all 3 bureaus. The 3-bureau FICO Score Simulator is only available from myFICO!

Our other tools help you review what's helping and hurting your score, and see up-to-date interest rates for mortgage and auto loans based on your FICO Score.

Education & Community:

Build your credit skills

Visit our credit education center to learn about credit, FICO Scores and credit reports. You can also find tips on improving your credit and ask your credit questions to our active 750,000 member user forums.

If you need to speak with us, just call our toll-free US-based customer support. With myFICO, you can learn about credit from the company that invented the FICO Score.

Choose a plan

Compare subscription plans and one-time credit reports.