Get the credit score home lenders use

Your FICO® Score could save you money by helping you secure better interest rates. Prepare for your loan with myFICO.

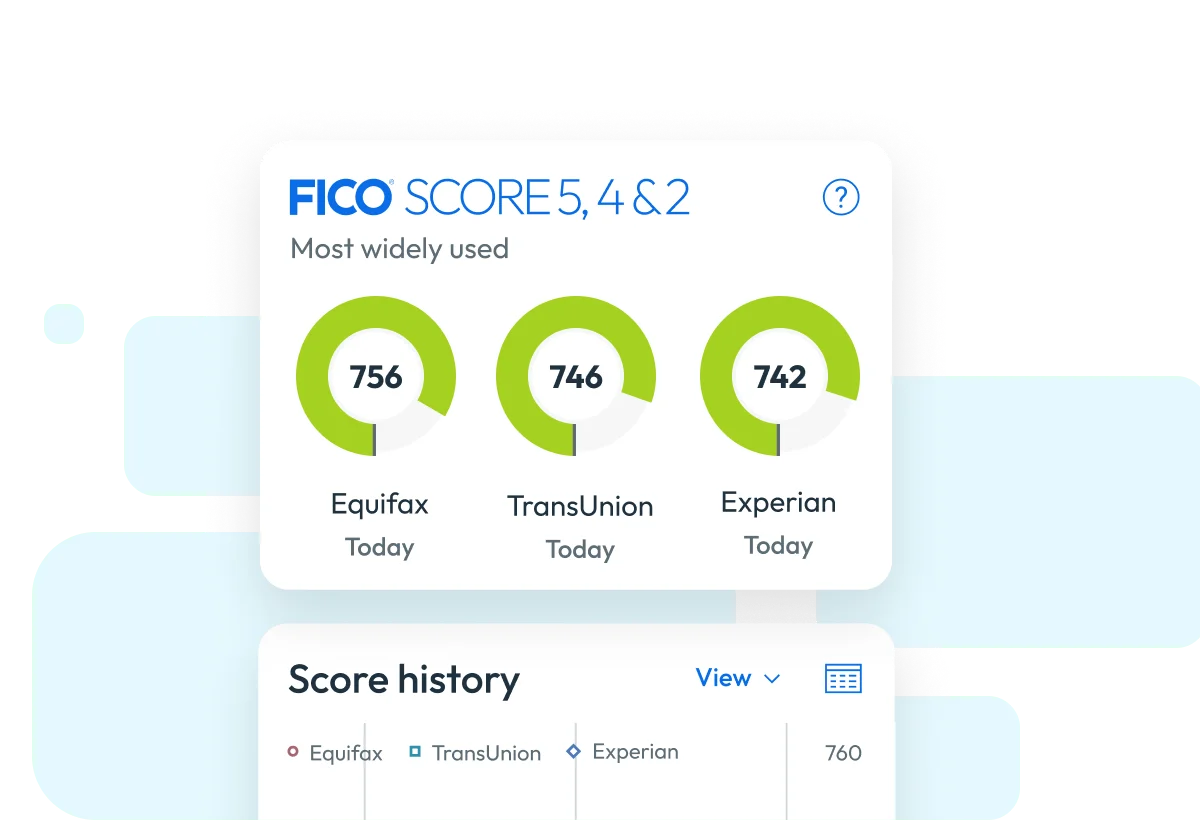

- FICO® Scores used for mortgages + other common FICO Scores

- The credit score used by 90% of top lenders

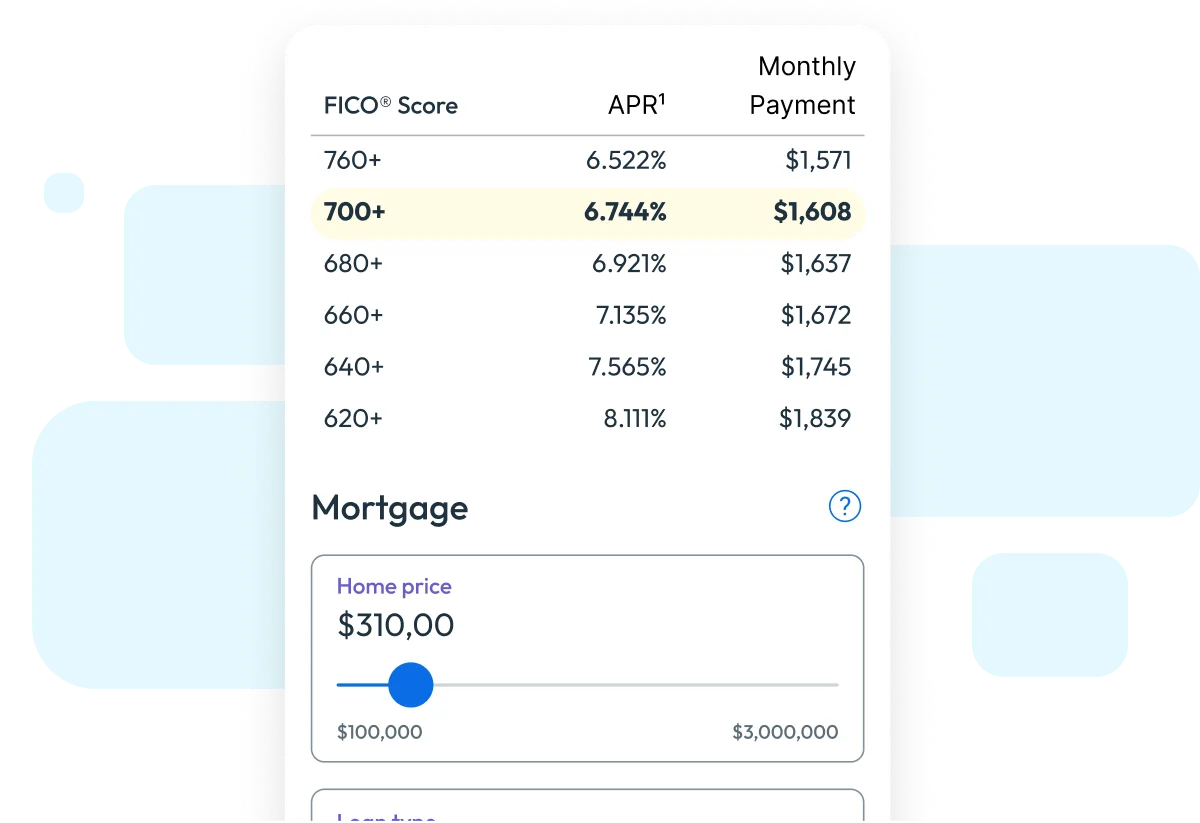

- Personalized, up-to-date interest rates for mortgage and auto loans.

IMPORTANT INFORMATION

1. Your subscription will automatically renew monthly at $29.95 unless you cancel. You may cancel at any time; however partial month refunds are not available. All subscriptions include a FICO® Score 8, and may include additional FICO® Score versions. Your lender or insurer may use a different FICO® Score than the versions you receive from myFICO, or another type of credit score altogether. Learn more.

IMPORTANT INFORMATION

2. Interest rates from Curinos LLC. Data is obtained from public sources; accuracy and completeness is not guaranteed. Curinos is not liable for reliance on the data. APRs calculated using 20% down with one discount point on a credit score above 620 for a single family, owner-occupied property.

IMPORTANT INFORMATION

1. Your subscription automatically renews monthly at $0 for Free Plan, $29.95 for Advanced, or $39.95 for Premier, unless you cancel. You may cancel at any time; however partial month refunds are not available. All subscriptions include a FICO® Score 8, and may include additional FICO® Score versions. Your lender or insurer may use a different FICO® Score than the versions you receive from myFICO, or another type of credit score altogether. Learn more.

2. Not all credit report data or transactions are monitored. Monitored credit report data, monitored credit report data change alerts, FICO® Score updates, FICO® Score alerts, monitored transactions, and alert triggers, timing and frequencies vary by credit bureau. Other limitations apply. Learn more.

3. The Identity Theft Insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits.

What people say about us

Rated 4.8 out of 5 stars by our customers

(Based on 22.7K22,700 reviews on the App Store)