The 5 Secrets of Excellent Credit Score Individuals

, by Rob Kaufman

Achieving the status of having an excellent credit score takes a lot of time and work. It can be accomplished by practicing proven methods of good financial management - two of which include paying bills on time and keeping low to moderate debt. (Keep those in your back pocket as you continue to read...)

So, what do people with high credit scores have in common?

Here are 5 top characteristics and habits that have helped them get there:

-

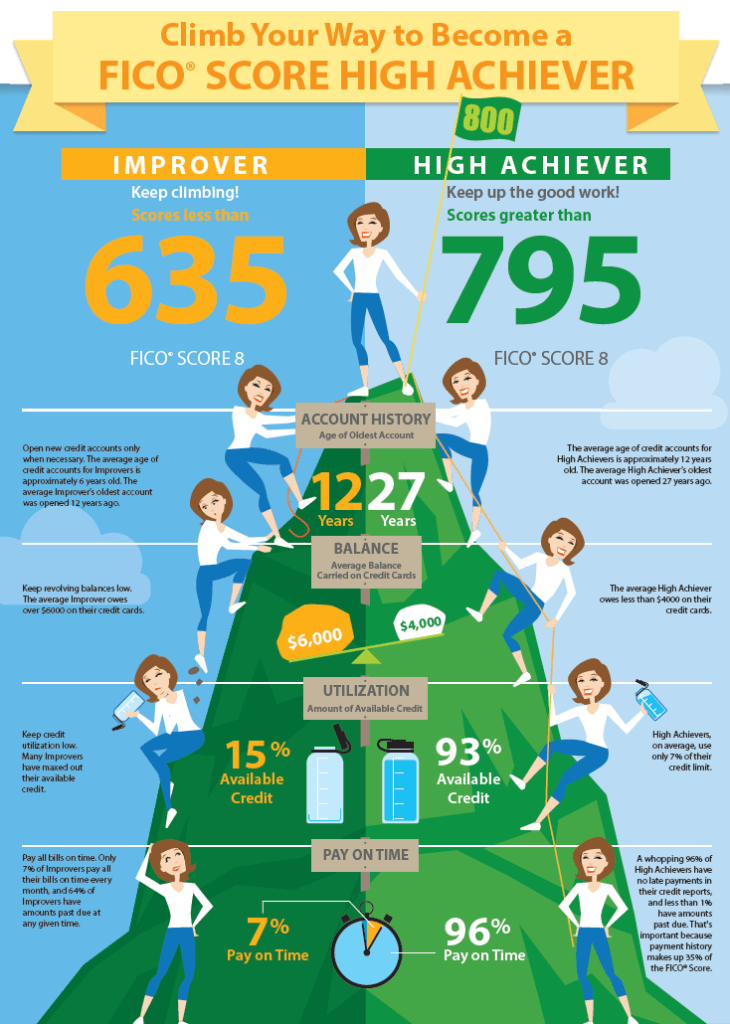

Pay your bills on time. It makes perfect sense that since payment history accounts for 35% of your credit score, paying bills on time is a crucial factor in attaining an excellent score. One late payment is enough to negatively affect a credit score. Here's an interesting fact: 96% of consumers with an 800 credit score pay credit accounts on time; 68% of those with a score of 650 have past due accounts. So if you want to have an excellent credit score, now's the time to become part of that 96%.

-

Minimize credit usage . Okay, back to some percentages: 800+ credit score ratings are obtained by those who use about 7% of their available credit while those with a score of 650 have typically maxed out their available credit. This is based on the "credit utilization" factor - which accounts for 30% of your credit score. This factor is the ratio of used credit divided by available credit. The higher the ratio, the lower the credit score. Research shows that shortly after you pay accounts with high credit utilization, your credit score will increase.

-

Try to avoid credit checks. Of course, you need to apply for credit for big-ticket items like a mortgage, car loan or even an additional credit card. It's the only way you'll be able to build credit. However, "overapplying" and getting hard inquiries dinged on your credit report will cause your credit score to drop. Multiple inquiries from lenders for your credit report within a short period of time can hurt your score. So if shopping for a mortgage or car, be sure to do your research within a 45-day span. That's a part of how the 800+ consumers do it and it's how you can do it, too!

-

Keep a long credit history. The length of your credit history accounts for 15% of their credit score. 800+ scorers have an average account history of 11 years (with the oldest account opened 25 years ago) while those with a score of 650 average an account history of 7 years (with the oldest account being 11 years old). This makes sense, right? The longer (and stronger) an account history, the more trustworthy your borrowing status. It's also important to remember that closing older, inactive accounts can hurt a credit score because it decreases your access to that available credit thereby increasing your credit utilization ratio.

-

Maintain low balances. Excellent credit is often a result of keeping low balances on credit cards. Most people who have 800+ credit scores never pay the interest due to the fact that their balances are paid in full every month. This characteristic goes hand and hand with the fact that most 800+ credit scorers know their finances inside and out. Ask them about their credit or accounts and they can tell you their account balances, credit score and more likely than not, their savings rate. Knowledge is power. And complete knowledge about your own finances can mean an excellent credit score now and in the future.

Want an 800+ credit score? See creative ways others have increased their FICO® Scores at myFICO forums.