FICO® Scores: How Often Do They Change?

, by Tom Quinn

FICO® Scores are dynamic - moving up or down as the underlying information in your credit report changes. How quickly your FICO Scores change or "migrate" and by how much depends on your credit-related actions and behaviors as reported to the credit bureaus.

So how much do FICO® Scores migrate in the short and long-term? Do migration trends vary for different population segments?

Recent FICO® research investigated FICO® Score migration on a nationally representative matched sample of active bankcard accounts that were depersonalized. The research examined scores over one-month, three-month and twelve-month time periods.

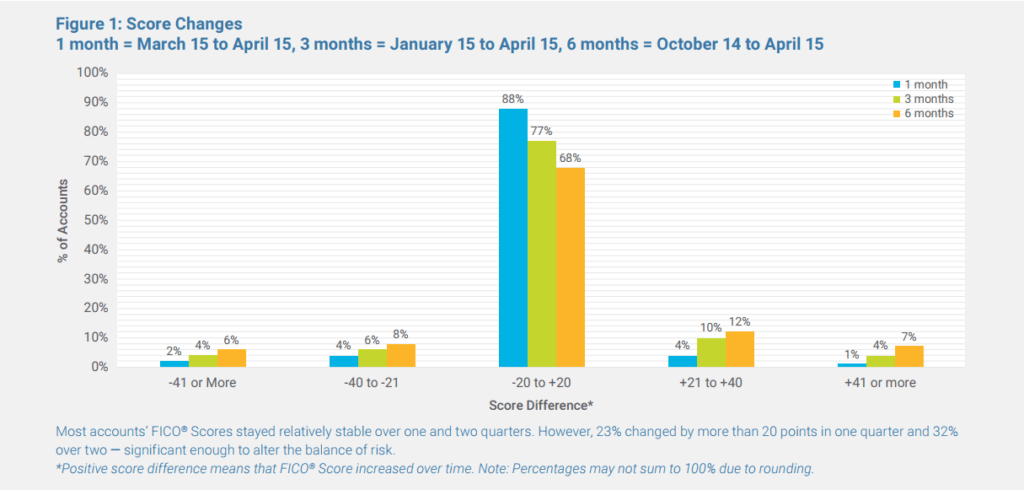

Figure 1 and the bullet-points below illustrate and discuss the findings:

-

A notable percentage of scores migrated up or down more than 20 points over one month, one quarter or two quarters - from 12% in one month, 23% in one quarter and 32% over six months.

-

The longer the elapsed time period, the more likely a larger migration (i.e., score changes more than 40 points up or down) had occurred.

A substantial drop in scores is typically the result of new delinquency being reported and/or the consumer's accounts having higher balances or the consumer having higher credit utilization. The typical drivers of a larger score increase include having lower balances and lower credit utilization, as well as aging of the credit history (e.g., the time since credit accounts were opened and/or the time since delinquencies were posted).

-

Higher FICO® Scores were more likely to remain stable. For example, 86% of the records scoring 750+ stayed within 20 points of their starting scores when re-examined three months later.

-

Records with lower starting FICO® Scores were more likely to experience a score change. In the under 550 segment, a majority of records (57%) migrated by more than 20 points over the following quarter. Note that many such consumers were improving their scores over time. For example, of those with a starting score less than 650 that migrated more than 20 points over a quarter, a majority tended to migrate in a positive direction.

-

Lastly, score migration in a particular direction did not typically signal an ongoing trend - the initial movement of a consumer's score up or down did not necessarily yield continued movement in that same direction in the next quarter. Scores that fluctuated by more than 20 points were more likely to either rebound from a drop or fall back from an increase than they were to continue with the recent trend.

As an example, a person's score may drop in the December-January time frame due to higher credit card balances being reported to the credit bureaus resulting from holiday spending, but may then rebound in March-April as those holiday balances are paid down.

Lenders rely on FICO® Scores to help them understand the likelihood of consumers paying their credit obligations as agreed. If changes in the underlying credit bureau data cause a FICO® Score to move up or down, that latest FICO® Score is the best predictor of future credit risk. Lenders typically obtain an updated FICO® Score when evaluating an application for credit.

While these score migration insights at a macro level are interesting, what insights do they provide to individuals about their own FICO® Scores?

-

Your FICO® Scores are dynamic - they change as the underlying information in your credit report changes based on your evolving credit-related actions and behaviors.

-

A low score doesn't have to haunt you forever. Access your FICO® Scores and learn what negative factors are impacting them the most. Focus on addressing those behaviors to help improve your FICO® Scores over time.

-

If you have a higher score, monitor and protect that credit rating you've worked so hard to get. A single missed payment can result in a substantial point drop.

-

If you are planning on applying for credit (to finance an automobile purchase for example) in the near term, access and check your credit reports and FICO® Scores several months in advance to ensure the information in your credit reports is accurate and to get insights on how to potentially increase your credit scores before you apply for credit.

myFICO has a community where you can discuss the changes in your FICO® Scores with peers. Join the myFICO Forums now.

The original research discussed here can be found here : http://www.fico.com/en/latest-thinking/white-papers/fico-research-scoring-your-customers