Are You Having a "Holiday Credit Hangover"?

, by Tom Quinn

Now that the holiday season is over it's time to pack away the decorations, work on shedding the extra five pounds gained from over-indulgence of sweets and other delectables, and opening your January credit card statements to get a sense of the potential "damage" of your holiday season shopping activity.

The holidays are a time of giving and festivities so it's common for individuals to increase their spending around that time of the year. Increased spending is not necessarily a bad thing, but it can become a problem when it leads to significantly higher credit card balances or missed payments - a credit "hangover," which can have a negative impact on your FICO® Scores.

FICO research shows that the average revolving debt (the type of debt incurred by using credit cards) was 4.5% higher in January 2017 than in October 2016. Young consumers (ages 18-34) exhibited the largest percent increase (5.0%) of any age group, driven by the fact that their average revolving debt levels are the lowest of all age groups.

| Age | Average revolving balance - October 2016 | Average revolving balance - January 2017 | Revolving balance % increase |

| 18-34 | $3,826 | $4,019 | 5.0% |

| 35-49 | $7,714 | $8,067 | 4.6% |

| 50-64 | $7,914 | $8,273 | 4.5% |

| 65+ | $5,027 | $5,217 | 3.8% |

| __Total__ | __$6,058__ | __$6,328__ | __4.5%__ |

Also of interest, 33% of Americans increased their total credit card debt by 10% or more between October 2016 and January 2017.

| Year | The percentage of people who increased total debt balance by at least 10% between October and the following January |

| 2014-2015 | 30% |

| 2015-2016 | 32% |

| 2016-2017 | 33% |

Credit utilization is a key component of the "amounts owed" category of a FICO® Score, which determines roughly 30% of a FICO® Score. "Amounts owed" is the second most important category in the FICO® Score, behind only whether you make your payments on time, which makes up roughly 35% of the FICO® Score calculation.

Racking up large revolving balances may lead to you being overextended and potentially more likely to miss payments. Conversely, people with lower debt and credit utilization levels tend to be less likely to miss payments, and as such, tend to score higher due to their more careful use of credit.

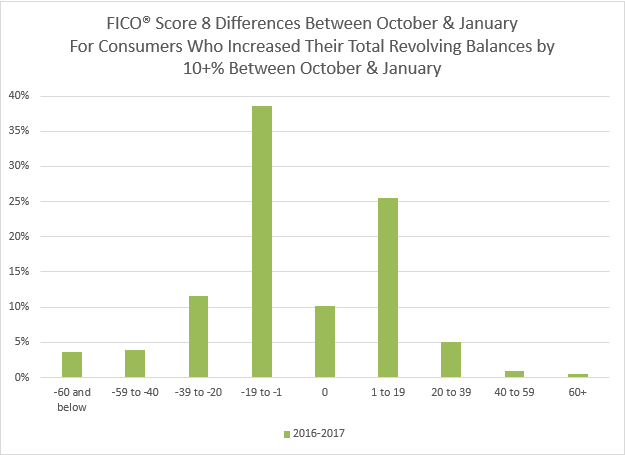

To quantify the impact that a holiday ramp-up in revolving debt can have on a FICO® Score, we analyzed FICO® Score shifts of those consumers with an increase of 10% or more in revolving debt amount between October and January of the following year (see Figure 1).

-

Of this population, almost twice as many consumers see their FICO® Score decrease (57%) vs. increase (33%) between October and January

-

1 in 5 of these consumers experience FICO® Score decreases of 20 points or more

- - This is higher than the total population, where only 1 in 9 consumers have FICO® Score decreases of 20 points or more.

For further information on these statistics, please visit http://www.fico.com/en/blogs/uncategorized/how-the-holidays-can-impact-your-fico-score/

Figure 1

How can you help treat a holiday credit hangover? The first ingredient is to make sure you pay all bills on time. The second ingredient is to reduce those revolving account balances as quickly as you can by paying off more than the minimum payment due and limiting new charges. Lastly, only apply for new credit if absolutely needed.

As with a "real" hangover, the speed and effectiveness of treating a hangover vary for each person!