Quiz Results: Do You Have a Good Understanding of FICO Scores?

, by Tom Quinn

April is National Financial Literacy Month which serves as a nice reminder on the importance of taking stock of your current financial standing as well as setting financial health-related goals and creating a process to track your progress.

This should include evaluating your FICO® Scores. A FICO Score is a number ranging between 300-850. Lenders use it to help them determine your credit risk and their willingness to extend you credit. Having a higher FICO® Score can mean increased access to credit at more affordable terms.

Do most people know what factors make up a FICO® Score, how FICO Scores are used and what actions to take to potentially increase their score over time?

We recently made a fun FICO® Score-related quiz available to myFICO members as well as to a random group of people to test how well individuals know their credit. The quiz consisted of 10 questions about credit, credit scoring, and lending practices.

First, thank you to the thousands of people who spent 5 minutes taking the quiz (that was the average time it took to complete the questions). The results surfaced strong awareness in some areas, room for improvement in others, and score knowledge differences between myFICO customers and random quiz participants.

-

While participants from both groups answered many questions correctly, the myFICO responders had a higher average score (80%) for correct answers compared to an average score of 60% with the random group . Perhaps indicating that exposure to your score and ancillary credit-focused educational content increases credit score understanding.

-

In both groups, almost all responders (~90%), clearly understood that income, where you live, having a college degree, and marital status are not considered in a FICO ® Score.

-

Somewhat surprisingly, about 40% of both groups missed the question on what information in a credit report typically has the greatest impact on a FICO® Score. The correct answer is "Have I paid my bills on time?". Of those that missed, almost all selected "How much debt do I have?" instead. Note, both categories are heavily weighted in the score so this, perhaps, should be treated as a partially correct answer!

-

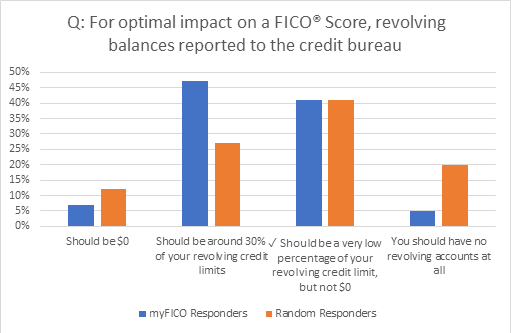

The most commonly missed question by both groups centered on the impact of revolving balances on FICO® Scores (see the question below). The correct response is to keep reported balances very low, but not $0. The data shows that having no revolving utilization is slightly riskier than having a small revolving utilization percentage. It demonstrates you have credit and are using it responsibly.

-

About 25% of the random group mistakenly thought it was true that spouses' FICO® Scores are averaged when you get married. Credit files are created and maintained at the individual level.

-

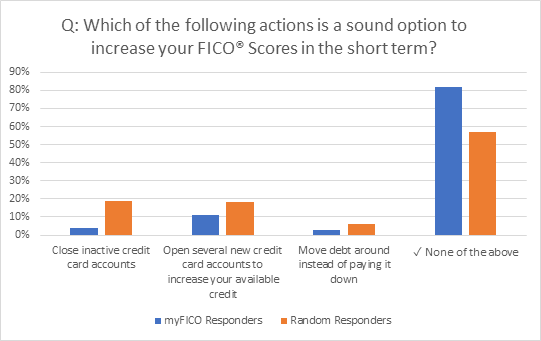

While the majority of responders in both groups correctly answered the following question about actions to increase FICO® Scores in the short term, there is still a sizable segment in the random group who think that actions such as closing inactive accounts or opening several new accounts in a short time period are sound strategies to quickly increase a score. In reality, these actions can have the opposite effect and result in a score decrease!

These results are promising as we engage in April's National Financial Literacy Month. Having a deeper understanding of your credit, credit score and how lending works can help you make better credit-related decisions and potentially save thousands of dollars in interest rates and fees. Didn't get a chance to take the quiz or simply want to learn more about credit scores? No worries! You can test your FICO® Score knowledge by playing with our Credit Galaxy game or visit the credit education section of myFICO for more score-related information. We encourage you to engage, share content, and help us spread the word about the importance of financial and credit education.

Random response group secured via Survey Monkey