Romance and Financial Compatibility: Questions to Think About

, by Tom Quinn

As summer is finally upon us, the wedding season is heating up. In fact, around 80% of weddings take place between May and October according to Priceonomics.

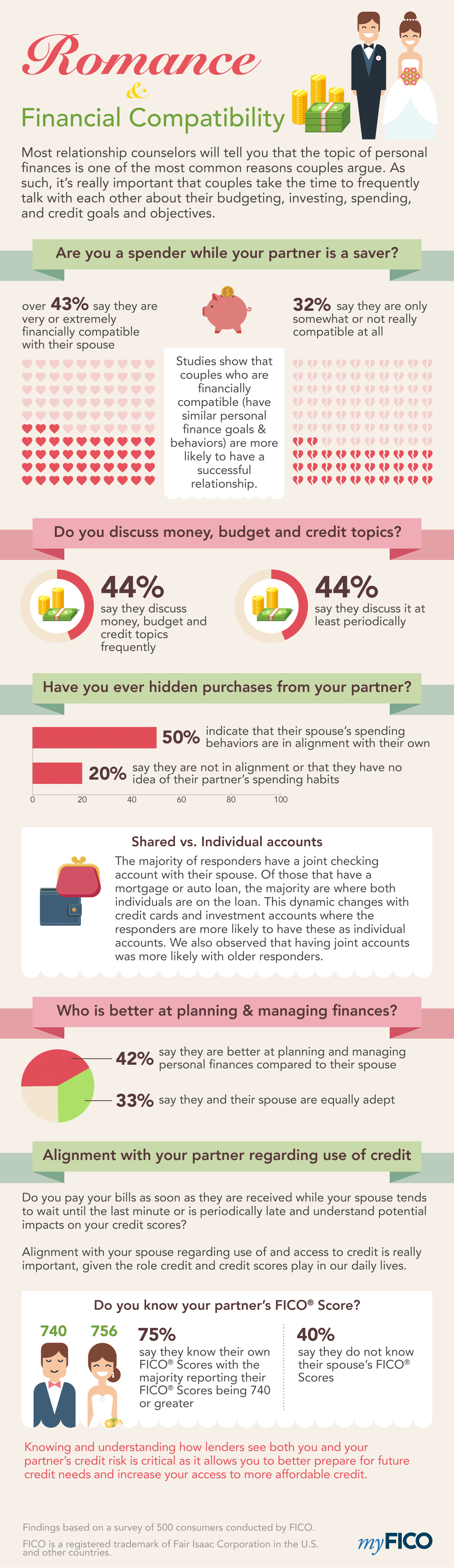

It's easy to get singularly caught up in the planning of the big day. But most relationship counselors will tell you that the topic of personal finances is one of the most common factors of stress for couples. Moreover, a wedding is usually a major expense so it's not surprising that this event can strain a relationship. Therefore, it's really important that couples take the time to frequently talk about their budgeting, investing, spending and credit goals and objectives __ before and after __ getting married.

I know ... sounds really romantic, right? Perhaps we can help. We recently conducted a survey of married people to get insights into the financial habits and compatibility within their relationships.1

So why not grab a bottle of wine and use these insights as a starting point for your financial conversation?

Studies show that couples who are financially compatible (have similar personal finance goals & behaviors) are more likely to have a successful relationship. Over 43% of the survey responders indicate they are very or extremely financially compatible with their spouse. On the flip side, a sizable number, 32%, responded that they are only somewhat or not really compatible at all.

A failure to communicate doesn't appear to be an issue with the survey responders as over 44% indicate they discuss money, budget and credit topics frequently. An additional 44% indicate it's communicated at least periodically. Your financial situation and objectives are likely to change over time so frequent dialogue can help make sure you and your spouse remain aligned.

Have you ever purchased something, but then hid it from your partner?

Over 50% of responders indicate that their spouse's spending behaviors are in alignment with their own. However, almost 20% indicate they are not in alignment or that they have no idea of their spouse's spending habits.

In terms of shared versus individual accounts, the majority of responders have a joint checking account with their spouse and of those that have a mortgage or auto loan, the majority are where both spouses are on the loan. This dynamic changes with credit card and investment accounts where the responders are more likely to have these as individual accounts. We also observed that having joint accounts was more likely with older responders.

42% of responders indicate that they are better at planning and managing personal finances compared to their spouse ( it would be interesting to see if their spouse agrees! ), while a third of responders indicate they and their spouse are equally adept.

Do you pay your bills as soon as they are received, while your partner tends to wait until the last minute or is periodically late? Do you pay your credit card balances in full, while your partner only pays the minimum amount due?

Alignment with your partner regarding the use of and access to credit is really important, given the role credit and credit scores play in our daily lives. 75% of responders indicate they know their own FICO Scores, with the majority reporting their FICO Scores being 740 or greater. Responders are less likely, however, to know their spouse's FICO Scores - close to 40% indicating they did not know.

Knowing and understanding how lenders see both you and your partner's credit risk is critical as it allows couples to better prepare for future credit needs and increase their access to more affordable credit.

1 Findings shared based on a survey of 500 married people conducted by FICO.